Fraud has long been a problem for financial institutions, and the growing threat of AI-supported fraud attempts is not making things any easier. On the other hand, AI can also be operationalized in support of fraud detection and to improve customer experiences, and done right this can be a major differentiator for global banks.

That’s what NatWest Bank, a leading retail and commercial bank in the UK, set out to do with the help of Camunda. Joanne Barry, Head of Technology Fraud Prevention COE at NatWest, led off her recent CamundaCon presentation by quoting the CEO of NatWest, Paul Thwaite, whose stated goal is to “build a simpler, more integrated and technology-driven bank that is capable of even greater impact.” One of the most powerful ways to do that in 2025 is by operationalizing AI.

A complex environment

Milesh Chudasama, Digital Transformation Director at NatWest, then took the stage to set the scene. The Fraud Center of Excellence group at NatWest includes over 800 fraud center agents using an average of 14 applications per call, with over 60 tools available to them across a range of platforms.

As you can imagine, this is a complex setup and it takes a long time to train people well to provide a good customer experience and to be in full compliance with regulations. And when they leave, all that painstaking training goes with them.

The lack of standardization

Inconsistency from a lack of standardization is a big problem. This not only means that customers are not served in the same way every call, but it also means that processes are often recreated across multiple platforms, duplicating effort.

Milesh explained that a lack of orchestration is holding them back, and that “what we want to do is create a good solid process orchestration engine.” This will enable a headless architecture that they can replicate across as many platforms as they need to, saving enormous amounts of time and effort.

Unlocking the value of AI for fraud detection

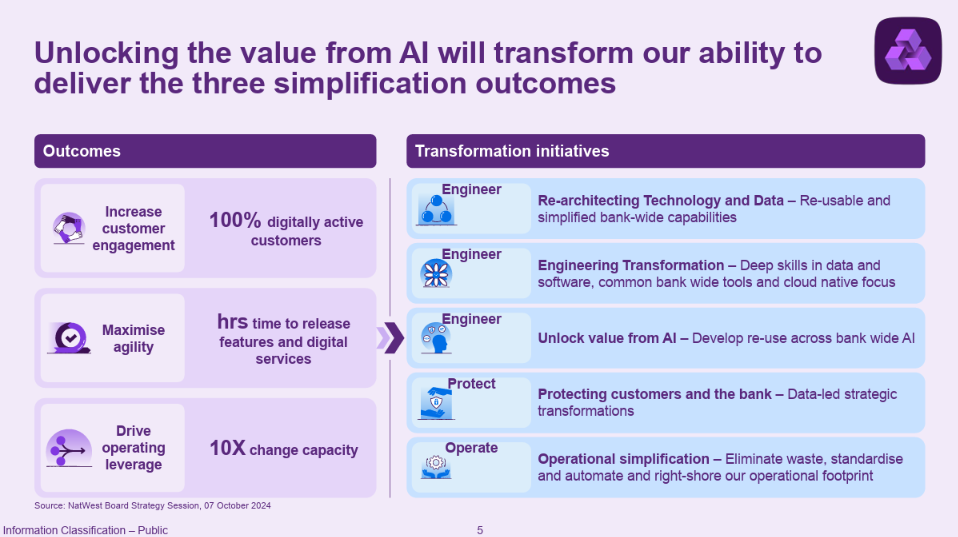

NatWest is looking for AI to drive specific business outcomes. Joanne explained, “We know AI will transform our ability to deliver” these key results:

- Increase customer engagement

- Maximize agility

- Drive operating leverage

To drive those outcomes, they have outlined a series of initiatives where AI can produce valuable results. As Milesh put it, the goal is to “use AI in the right way, and not let it run free… and do some stuff that can damage your reputation.”

Analyzing and digesting large amounts of data, along with writing and testing code, were powerful ways that the team is able to use AI to speed up their work and reduce their time to market. AI can also build on existing rules-based systems for something like anomaly detection, helping them detect patterns quickly and be more proactive, rather than reactive.

One exciting initiative included using AI within Camunda to move “the creation of initial BPMN diagrams to the left, so that the business generates it themselves,” which will result in much tighter business-IT alignment and accelerate the way they build processes to begin with. AI will also help the team reduce the number of applications they need to touch to solve a problem, improving the way a process is “governed and managed by a human and an AI agent” or by straight-through processing.

Disrupt and transform

AI clearly has the power to both disrupt and transform banking and financial services. The team at NatWest has identified a number of opportunities.

- Customer experience: AI can respond faster and automate more cases, improving customer satisfaction.

- Engineering productivity: AI tools can help teams write code or design BPMN diagrams much more rapidly than before, speeding up production and making collaboration easier.

- Process simplification: Features like Optimize give them data points so they can understand what works and what doesn’t, and where AI can be most effective.

- Fraud/Financial crime: Understanding patterns and which things to react to and which not to, which is critical with the reports of fraud growing daily.

One key Milesh highlighted was the ability to determine “how far you want the AI to service a customer before you break out from the AI” and hand off to a human. This is a critical step in ensuring a good customer experience and avoiding the problems of AI attempting to navigate an issue that is too complex for it.

What’s next?

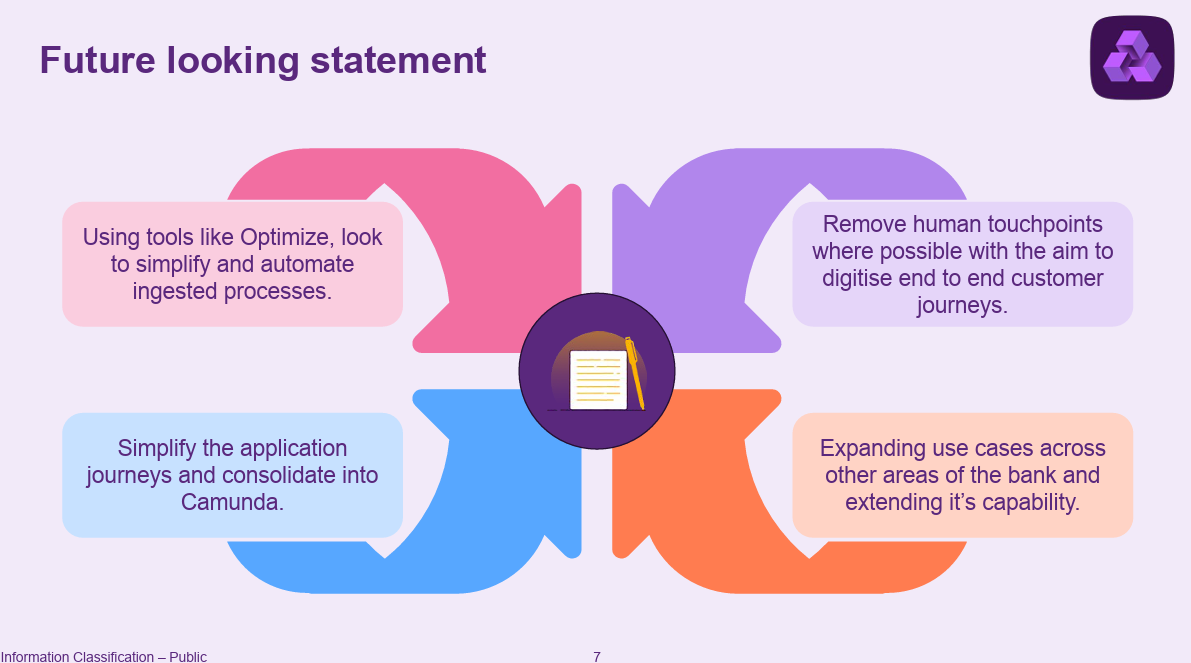

Milesh noted that what he really wants his team to do is make sure the customer gets the same journey no matter how they interact with the company. “Not omnichannel,” he observed, “let’s call it optichannel—the right customer to the right journey to get the right output.” Using tools like Optimize to simplify and automate processes, and orchestrating end-to-end with Camunda to better understand processes and remove human touchpoints where it’s most effective, will help them get there faster.

See the full presentation and more from CamundaCon Amsterdam 2025

You can check out the full presentation from NatWest here or watch it below, and for more be sure to check out all the recordings from CamundaCon Amsterdam 2025.

If you liked this and wish you’d seen it live, don’t miss your chance to join us at the next CamundaCon! Register now for CamundaCon New York 2025.

Start the discussion at forum.camunda.io